July Housing Starts Suggest Demand is Steady in Alberta

- August 5, 2017

- By Cody Battershill

New Housing Starts Steady, Point Towards Economic Recovery

Despite oil prices hovering below $50 US a barrel for quite some time, Alberta’s new home builders are staying optimistic as the demand for new homes last month remained steady.

In July of 2017, there were 33,535 new housing starts in the province. This figure is presented at an annualized rate (the number of new properties that would be constructed in a years’ time if the same pace of activity was sustained for a period of 12 months) and is seasonally adjusted (removal of the seasonal pattern in time series for a given data set).

Furthermore, it was the 5th consecutive month where new housing starts came in above the 30,000 range. Also see Alberta New Housing Starts Up in March 2017.

Calgary CMA Housing Starts

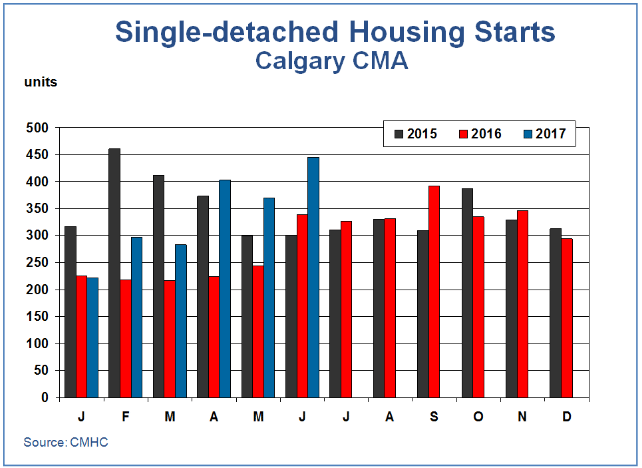

Single-detached – housing starts increased in June 2017 by 31.3% year-over-year to 445 units, the best levels seen in the Calgary area since February 2015

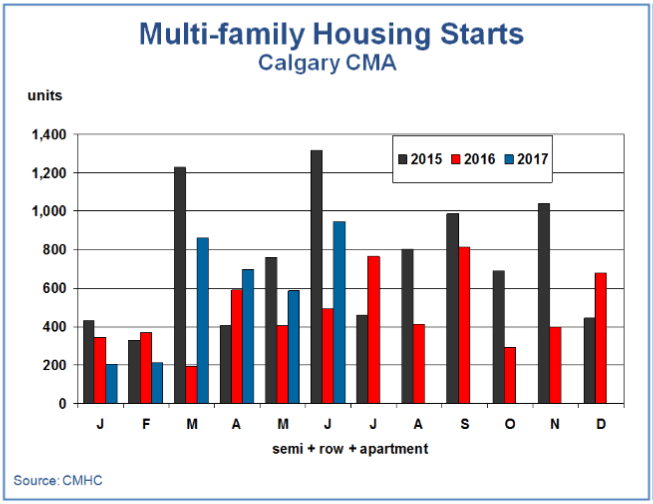

Multi-family – housing starts increased in June 2017 by 92.5% year-over-year to 945 units. This was the fourth consecutive month of considerable gains year-over-year for the sector.

New home inventories – A total of 617 completed and unoccupied single / semi-detached properties (including show homes) in June 2017, up from 501 units year-over-year and 581 the previous month.

New multi-family inventories – A total of 1,300 completed and unoccupied townhomes and apartments in June 2017, up from 591 units year-over-year but down from 1,342 units the previous month.

Reasons for Steady Demand in New Home Market

So, what are some of the factors driving consumers to buy new homes in Alberta, a province that has been hit hard economically with the third highest unemployment rate in Canada as of July 2017?

#1 – Price

Over the past few years, benchmark prices for both new and resale properties in the province barely changed compared to other types of product.

Now that there are some indicators that the provinces economy is recovering, buyers who were staying their decisions to make a move are jumping into a market with some level of confidence that prices will not drop any further.

#2 – Mortgage Rates

The Bank of Canada just increased interest rates in July of 2017, an act that many buyers did not anticipate at the beginning of spring and may result in further increases to borrowing costs in the last few months of the year.

This has encouraged buyers to begin shopping for a home sooner than later before interest rates possibly rise yet again as waiting may simply cost more money.

#3 – Selection

Inventory levels have remained relatively high for all sectors of the market, especially the apartment sector. Buyers have many more options when it comes to home selection and price negotiations with the seller; it’s currently a buyers’ market and will likely be for some time to come.

The Western Canadian province may be on the up-and-up when it comes to the economy, although the recovery remains slow and steady. Alberta’s home builders will want to proceed with caution as if too much new product enters the new market, prices could be pushed downward because of lower demand and higher vacancy rates.

The Western Canadian province may be on the up-and-up when it comes to the economy, although the recovery remains slow and steady. Alberta’s home builders will want to proceed with caution as if too much new product enters the new market, prices could be pushed downward because of lower demand and higher vacancy rates.

*Sourced from the Canadian Home Builders’ Association (CHBA), Statistics Canada, ATB Financial